Enterprise Class flights, upgrades to resort suites, personal lounge entry at airports and chain lodges…these are all of the area of the rich and the frequent government vacationers, proper? Not essentially. You possibly can be part of their way of life at any time if you happen to faucet into the correct bank card perks for vacationers.

Each occasionally I’ll be on a tour or staying at a resort the place I can’t assist however hear the conversations round me. Generally I hear one thing that makes me cease what I’m doing and pay attention. As soon as I used to be on a visit to Peru the place on the desk subsequent to me, one traveler requested, in amazement, “Why would you employ a debit card to pay for an $8,000 tour? Are you out of your thoughts?!”

The recipient of this query mumbled one thing about accountable spending and never going into debt, however the others three on the desk hit him with a barrage of arguments about why this was a dumb transfer. On the finish it had him saying, “Okay, OKAY—I get it. So what journey card ought to I get?”

On the one hand, you’ve bought to admire a man who bought to retirement age with out placing issues on a bank card. That restraint and financial duty are admirable. Then again, half the individuals at that desk I used to be eavesdropping on had not paid for his or her flight—they cashed in frequent flyer miles to get to Peru. All of them had been staying on an additional day or two at no cost additionally: they cashed in resort factors to spend additional time in Lima.

This man, then again, had laid out loads of actual cash to get there and was flying residence the day the tour was over. All of them paid the identical quantity for the tour upon arrival, however they definitely didn’t pay the identical quantity for transportation or lodging. Plus those taking part in the bank card perks sport bought an additional 8K factors at a minimal once they put the price of the tour on the correct card.

Journey Hacking Vs. Leaving Cash on the Desk

Because it got here out within the dialog I used to be eavesdropping on, there are those that exploit the alternatives to raise their journey and those that don’t even know the alternatives exist. The previous are showered with perks, the latter—accountable as they might be with their cash—find yourself wanting like suckers. “Do it’s a must to pay to test a bag?” one requested. “Do you will have World Entry and TSA Pre-check paid for?” requested one other. “Do you get a room improve while you test right into a resort?” a 3rd chimed in.

The purpose they had been making—and it wasn’t laborious to make—was that getting the correct bank cards could make your journey life much more nice. In case you cost issues and by no means pay any curiosity since you pay the cardboard off every month, you then’re solely out the annual charge. With some playing cards the annual charge pays for itself (or near it) because of the anniversary bonuses they offer you for sticking round.

Until you by no means take a flight or keep at chain lodges after getting the cardboard, it’s virtually unimaginable that even an off-the-cuff leisure traveler received’t come out forward. Plus the travels will probably be extra comfy because of your elevated standing.

The resort and airline loyalty packages are a sport. Those that play the sport can win huge and get showered with journey perks and the sport is definitely fairly laborious to lose. The one individuals who actually lose badly are those that don’t play in any respect. You possibly can seize a few of the cash on the desk or you’ll be able to depart the money sitting there.

Airline Credit score Card Perks

In case you fly a sure airline (or their alliance) rather a lot, it’s a no brainer to get considered one of that airline’s bank cards. If there’s a juicy sign-up bonus being supplied, then you would find yourself with a free worldwide flight with out even incomes a single mile from flying. And today, you don’t earn a lot by flying, so getting the correct card will earn you extra anyway simply from placing payments and fuel pump expenses on the cardboard.

In case you get the Amex Gold Delta Skymiles card, as an example, with the provide as I write this you will get 50,000 miles after assembly the minimal spend in three months. I’ve seen extra beneficiant provides from them up to now, however that may typically get you to South America and again if you happen to’re versatile together with your dates, or at least pay for a visit to Mexico.

Perks embody a home free bag test, precedence boarding, tk. Spend $10K on it in a single yr and also you’ll get a $200 flight credit score too. I managed to try this in 2024 by placing plenty of payments on the cardboard and halved the worth of considered one of my tickets. See the small print right here.

You’ve bought to pay this one off each month although. The rate of interest begins at 20% after which rises additional into mortgage shark territory.

The American Airways card from Citi additionally has super-high rates of interest beginning at 20% and the identical underwhelming 50K provide at present. As with Delta, their free checked bag perk solely applies to home flights, so this one is best for US journey than worldwide flights the place there’s a bag charge, like ones to Mexico. (United’s card covers a bag on all flights although, in order that’s a greater one to get if you happen to’re not close to a hub for AA or Delta.)

The AA card has one big benefit although if you happen to fly American sufficient to get to elite standing: factors from bank card spending rely as elite miles. So it’s rather a lot simpler to purchase your option to standing and additional perks on AA than it’s on the others. One huge drawback for Latin America although: there is no such thing as a different OneWorld alliance accomplice that may get you to Central or South America. Their solely accomplice within the Americas left is Alaska Air.

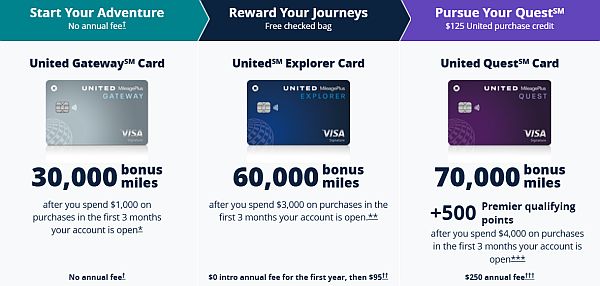

The United Airways Explorer Card is my high decide for airline bank cards as a result of it has the most effective perks by far. As talked about above, you get a free checked bag on all flights, not simply those throughout the USA. You possibly can see the three selections beneath, with a better annual charge getting extra extras, however the Explorer one with a 60,000-point sign-up bonus has a $99 charge, which is decrease than the 2 above however offer you extra factors up entrance.

You possibly can simply cowl the annual charge with saved baggage charges plus there’s one other big benefit that the others don’t provide: the Chase United Explorer and Quest playing cards include two free lounge passes per yr. That alone virtually cancels out the annual charge. Plus you don’t even pay the annual charge till the renewal date, not the primary yr. Final, United is a part of the Star Alliance, which suggests you’ll be able to earn or use factors on Copa Airways or Avianca.

They’ve an alternative choice I reduce off within the picture above since you pay greater than $500 a yr simply so as to add lounge entry. There are different methods to get lounge entry that received’t be so expensive until you might be in considered one of their hubs each month and can actually use it rather a lot.

Whereas the bonus is probably not as excessive at first look, 40,000 factors as I write this, you can too get a free flight to Central America or Mexico with the Southwest Chase card. In some methods these factors are value extra too. Southwest has a really standardized redemption components that’s simply associated to the price of the flight, with no “dynamic pricing” factors modifications on excessive demand days and no blackout dates. So these factors are a lot simpler to money in at no cost flights than with the opposite legacy carriers. Plus no bag charges ever.

There’s only one huge draw back with this Southwest card although, an odd one for an airline card: it expenses international transaction charges. So that you don’t wish to use it exterior of the USA as a result of that’s simply handing more money for nothing to Chase.

They not offer you free drink tickets in your card anniversary, however they do deposit just a few thousand additional miles in your account, which offsets a few of the annual charge. That annual charge is the bottom of the key airline playing cards too, at $69.

In case you fly to Latin America a number of occasions per yr on a selected airline, chances are you’ll wish to look into ones supplied by a international provider. The Avianca one has a status as being probably the most beneficiant with its factors, however you can too get ones from Aeromexico, Copa, or LATAM.

The Pleasure of Having a Lodge Branded Credit score Card

Whereas an economic system seat on an airline won’t get you very excited, how about automated room upgrades and free resort nights at a luxurious property?

Not all resort loyalty program playing cards are created equal as a result of the packages aren’t as comparable because the airline ones. Some could have straightforward redemption at 15,000 factors, whereas on others that may not even get you right into a motel. I’ve playing cards from Hilton and IHG personally. The primary I bought as a result of the sign-up bonus was big and I ended up getting three nights on three events simply from the sign-up bonus.

The Hilton card provide varies, however proper now it’s a whopping 165,000 factors for his or her Surpass card with a $150 annual charge. I exploit this one and the IHG one beneath regularly, scoring 16 free nights between the 2 of them final yr. With so many factors awarded to you up entrance and the benefit of build up extra by way of their spending multipliers, you would simply money in for a few nights on the Conrad Punta de Mita or Waldorf-Astoria Panama Metropolis.

E-book this resort with Hilton loyalty factors earned with bank card spending

You get Gold standing robotically when you will have this card too, which might result in journey perks like room upgrades, free breakfast, or government lounge entry.

I’m a giant fan of the IHG Rewards card from Chase. I’ve had it for greater than a decade now. I don’t adore it as a result of their lodges general are all that luxurious—although they do now have Kimpton and Six Senses within the combine—however as a result of the purpose cash-in ranges are fairly cheap. You possibly can typically get into an Intercontinental or Crowne Plaza for a degree whole that’s typically half what you see for a comparable property at Marriott.

Plus yearly upon renewal they offer you a free evening for any resort as much as 40K factors, which is nice to money in while you want an airport resort or a street journey cease and don’t really feel like laying out the cash for that. I’ve cashed in factors with them in Mexico, Nicaragua, Costa Rica, Chile, Argentina, and Colombia simply in Latin America, extra in Europe and the USA.

As I write this, if you happen to get the IHG Rewards One Premier card that I’ve, you get 4 free nights at properties valued at 40K factors or much less after assembly the minimal spend. I can let you know from expertise that many of the Intercontinental properties in Latin America will are available in beneath that most if it’s not a vacation weekend and now there’s a Kimpton in Mexico Metropolis and one in Roatan, Honduras that we’re hoping to take a look at quickly.

This IHG bank card provides you Platinum Elite standing, which suggests you’ll normally get upgraded to a greater room and typically you get perks like lounge entry, snacks, or a partial factors rebate.

There are different resort card choices in fact if you happen to desire a distinct chain. The Hyatt one is kind of good by way of what you get from the bonus and spending, the Marriott one not a lot due to very excessive (and sophisticated) redemption ranges. The only one is through Barclays for Wyndham Rewards, which solely has three redemption ranges, however they don’t have many luxurious properties in Latin America.

Journey Credit score Playing cards With Convertible Factors

There’s additionally a bonus to having an Amex card with Membership Rewards or, perhaps even higher, a Chase Sapphire Rewards card. With these you’ll pay extra, however you’ll be able to switch your miles to a number of packages, supplying you with the power to “high off” your account to get to an award tier you want for a visit.

The best degree of these playing cards additionally get you plenty of perks like reimbursement for World Entry, reimbursement for bag charges, Precedence Go membership, and within the case of Amex, entry to their very own Centurion lounges.

In case you solely fly enterprise class or above, that’s okay. Use these factors to high off your whole and also you’ll have sufficient to improve or carry a partner. Plus you’ll earn big bonuses while you cost flights to those playing cards. Even if you happen to don’t have standing on a selected airline, you’ll get some bank card perks that prevent cash or velocity up your journey.

There’s a 3rd possibility for this you don’t hear as a lot about. Capital One has a premium card that enables transfers to completely different packages, plus they together with Precedence Go lounge entry for you and a few different individuals. That is the subsequent one I’m going so as to add to my pockets as a result of I’ve bought a few actually lengthy layovers arising this yr.

Which Credit score Card Perks Are Proper for You?

Which card do you have to get for the most effective journey perks?

Properly if that man on the desk subsequent to me in Peru had posed the query, I wouldn’t have answered instantly. I’d have requested him the place he lives, what airline he flies probably the most, and how much lodges he stays in. As I famous in this earlier put up, you might have entry to completely different resort manufacturers than the obvious with a few of these resort playing cards. However a card for an airline you by no means fly isn’t of a lot use.

I’d additionally inform him, nonetheless, to overlook getting only one. Ideally, you must a minimum of have one airline card, one resort card, and one bank card that lets you transfer factors to completely different accounts as wanted. This fashion you’ve bought the most effective probability of getting all of the bank card perks accessible.

Positive, that’s going to value you just a few hundred bucks a yr come renewal time, however you’ll simply earn that again from all the additional goodies you obtain.

If retaining observe of three playing cards makes your mind damage, then simply get the Chase Sapphire Most well-liked card so you’ll be able to switch factors to completely different accounts. You additionally get a rebate while you e book journey with them, plus you earn factors extra shortly with them than with Amex: 5X on purchases by way of Chase Journey, 3X on eating, 2X on different journey purchases.

Then as an alternative of spending $8,000 on a debit card that doesn’t do something for you, as an alternative you would be getting comped flights, free resort rooms, and perks that the common clients by no means see. Simply float that spending for a month and the journey hacking rewards might be big, even for luxurious vacationers.

Get on our insiders listing and obtain our month-to-month updates. Be part of us right here and also you’ll get a free report on how you can get a resort improve extra typically while you journey.

Disclosure: Luxurious Latin America is free to learn as a result of it’s reader-supported by way of promoting. Some hyperlinks on this put up could present us some compensation within the type of small commissions or loyalty factors. They may by no means value you greater than if you happen to went to the positioning straight.